Investment Principles

Evidentia Group is a boutique Asset Consultant. The firm works with select Private Wealth practices to design, build, implement, and manage tailored investment portfolios.

01.

Strategy Based Investing

Traditionally, portfolios are delivered to clients ‘off the shelf’ and do not take into account their specific set of needs and circumstances. Evidentia collaborates with advisers and builds portfolios which are relevant to their clients’ situations

02.

Embrace Market Pricing

To generate observable return premia, investment returns should be obtained by participating in capital markets. Investors should only take risks or pay fees where there is a reasonable expectation they will be rewarded.

03.

Taxes & fees matter

Net after-tax returns are important. Therefore, fees should be closely managed, monitored and budgeted for. While we believe some managers can add value and therefore are worthy of a higher fee we understand that unlike risk premia, alpha is a finite resource (zero sum game). Unless the alpha is identifiable, observable and statistically significant, we believe investors are unlikely to be rewarded for additional fees.

One of the benefits in creating purpose-built portfolios is that they are constructed for specific tax rates or tax preferences (such as sources of returns).

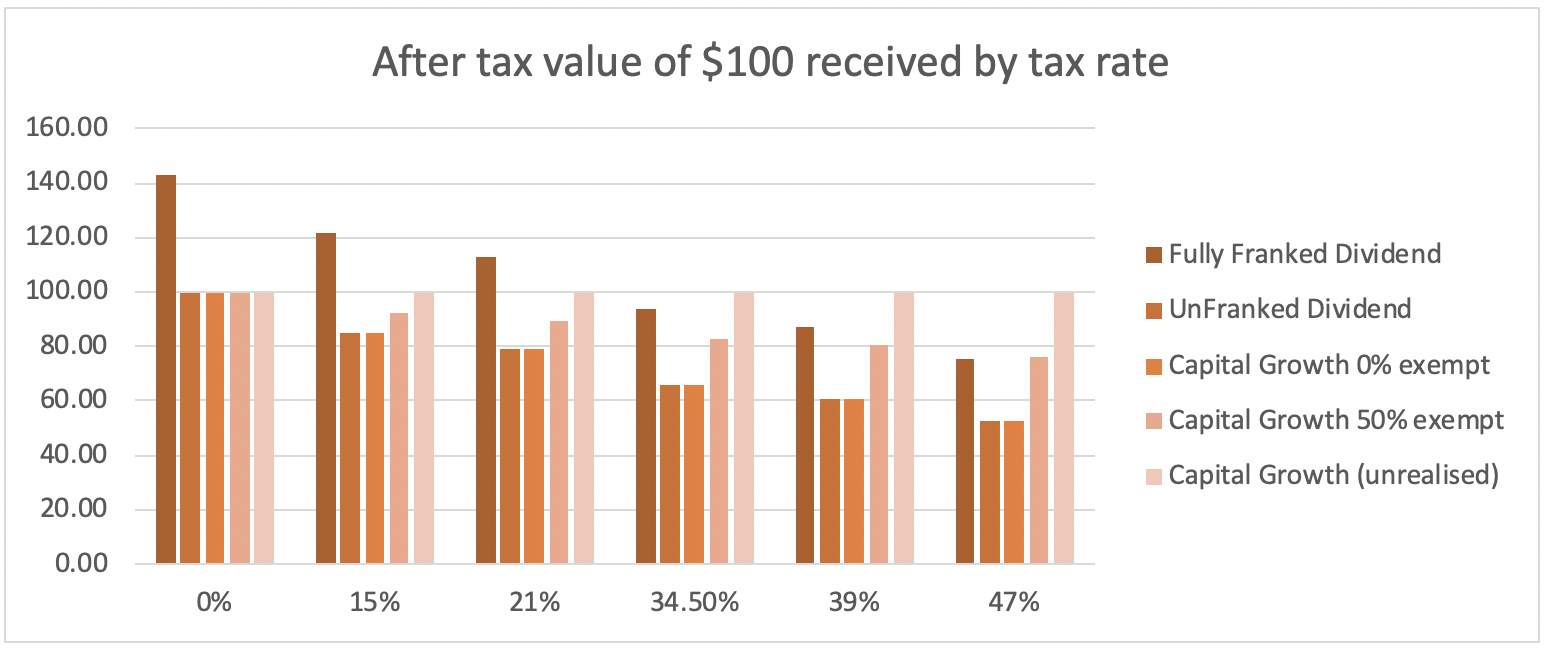

As the table below shows the after-tax return of $100 is materially different depending on firstly the source of return and secondly the tax rate of the investor.

04.

Valuation is important

Risk or permanent impairment of capital is a result of:

- Paying too much for an asset (valuation risk)

- Fundamental problems with the asset you are buying (business risk)

- Not being able to hold the asset through tough times (financing risk)

- Investors panicking and selling when they see volatility increase or their wealth decrease due to market movements (behavioural risk)

However, unlike many asset consultants we don’t view valuation as a major driver in the short term, but only over longer periods of time – 10-15 years

05.

Diversify

We view diversification as a genuine way of reducing uncertainty without compromising future returns.

While most investors understand the basic concept of diversification, studies show that investors still fail to diversify.

True diversification is about ensuring portfolios are diversified across:

- Asset Classes

- Countries

- Managers

- Styles

- Factor Premia

06.

Simplicity & understanding trump complexity

Investors should understand what assets they own and why they own them. They should also understand the risks they are taking and why they are taking them.